My diary

CREDIT

I'm still in shock that this happened. It's like I can't fathom that something so big, something so catastrophic could happen. I'm trying to figure out who to blame. I need someone to blame. I need to give a face to this economic panic. It's not real until I can blame someone for the hardship my families facing. According to the New York Times, that face isn't a face at all, but a name and its name is credit. I remember back when everything was good. Prosperity was shared by all. At least it felt that way. I think we all genuinely believed it would last forever. And with the ability to buy on credit coupled with low interest rates and this belief, no one was buying things up front anymore. It was all about borrowing and installments. The New York Times says that's where we went wrong. There was too much buying on credit and not enough actual spending. What we thought was prosperity was really everyone being heavily in debt. As I read more and more about the causes of the stock market crash, it seems that really villain that I'm searching for is right in front of me. And next to me on the side walk. And working alongside me in the factory. It's me and my parents and my friends and their parents. Everything I've read it seems to boil down to being the consumers fault. But it shouldn't be our fault. No one told us it wasn't okay. In fact, most of the time they were encouraging us to use credit and but into the stocks and to take out loans. No one told us it was wrong. No one told us to stop. So who's fault is it really? Who's job is it to tell us these things?

- Mary Anne Smith

The increase in installments and borrowing led to a widespread over-indebtedness which resulted in defaults on loans and bank failures. Buying on credit and paying through installments was heavily advertised.

briana32a

21 chapters

16 Apr 2020

Causes of the Great Depression

CREDIT

I'm still in shock that this happened. It's like I can't fathom that something so big, something so catastrophic could happen. I'm trying to figure out who to blame. I need someone to blame. I need to give a face to this economic panic. It's not real until I can blame someone for the hardship my families facing. According to the New York Times, that face isn't a face at all, but a name and its name is credit. I remember back when everything was good. Prosperity was shared by all. At least it felt that way. I think we all genuinely believed it would last forever. And with the ability to buy on credit coupled with low interest rates and this belief, no one was buying things up front anymore. It was all about borrowing and installments. The New York Times says that's where we went wrong. There was too much buying on credit and not enough actual spending. What we thought was prosperity was really everyone being heavily in debt. As I read more and more about the causes of the stock market crash, it seems that really villain that I'm searching for is right in front of me. And next to me on the side walk. And working alongside me in the factory. It's me and my parents and my friends and their parents. Everything I've read it seems to boil down to being the consumers fault. But it shouldn't be our fault. No one told us it wasn't okay. In fact, most of the time they were encouraging us to use credit and but into the stocks and to take out loans. No one told us it was wrong. No one told us to stop. So who's fault is it really? Who's job is it to tell us these things?

- Mary Anne Smith

The increase in installments and borrowing led to a widespread over-indebtedness which resulted in defaults on loans and bank failures. Buying on credit and paying through installments was heavily advertised.

http://www.traditionalcatholicpriest.com/wp-content/uploads/2015/06/1953_CreditCard_96.jpg

This picture depicts a women at a Sears store about to purchase something. But above her head Sears is advertising that their store has credit. They have a sign that says "charge it" encouraging customers to use credit to bu merchandise instead of buying upfront.

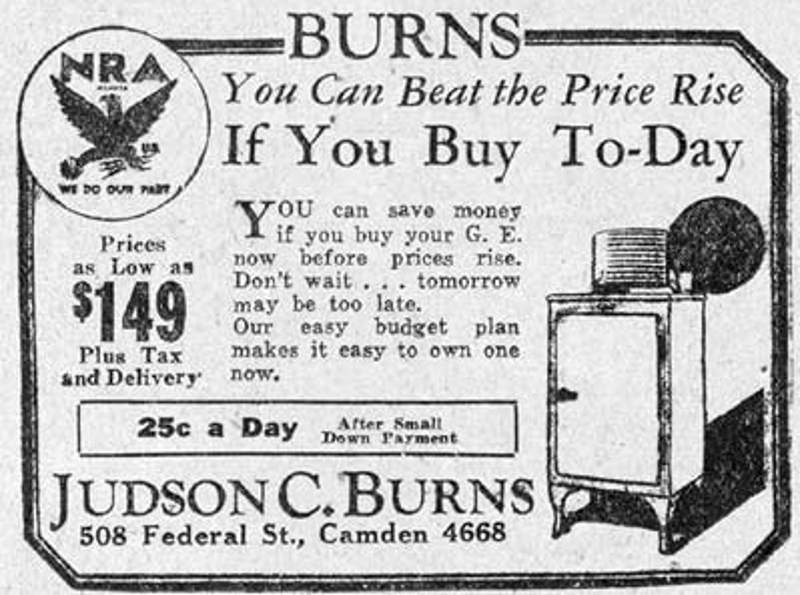

https://jkblick.wikispaces.com/file/view/0508-081633.jpg/292610704/0508-081633.jpg

This picture is of an advertisement for a washing machine. To get people to buy their machine, they tell readers to buy now before prices rise and to do so even if you don't have the money then and there. You can do this through their easy installment plan.

http://www.kevincmurphy.com/buynow.jpg

This picture depicts a sign telling people to buy on credit using the slogan "Buy Today, Pay Later". Buy today, pay later just leads to people in debt. What happens is people think because of credit I can get everything I wanted and then some and pay it back later. So instead of having to pay off a washing machine, people are paying off a washing machine, and a car, and a fridge, and ten other things. Instead of having to pay off $200, you are now drowning in a debt of $2000 to $3000.

1.

The Great Depression

2.

Causes of the Great Depression

3.

Causes of the Great Depression

4.

Causes of the Great Depression

5.

Causes of the Great Depression

6.

Causes of the Great Depression

7.

Causes of the Great Depression

8.

Causes of the Great Depression

9.

Life During the Great Depression

10.

Life During the Great Depression

11.

Life During the Great Depression

12.

Life During the Great Depression

13.

Life During the Great Depression

14.

Life During the Great Depression

15.

Life During the Great Depression

16.

Attempts to Fix the Great Depression

17.

Attempts to Fix the Great Depression

18.

Attempts to Fix the Great Depression

19.

Attempts to Fix the Great Depression

20.

Attempts to Fix the Great Depression

21.

Attempts to Fix the Great Depression